Sustainability-Inspired Evolution for Total Lifecycle Cost Optimization in Oil & Gas

By Alex Hooper

The Oil & Gas industry has perpetually faced a conundrum of volatility: although its product remains the world’s largest and most stable source of energy, its operations, production volumes, and profitability are often threatened by geopolitical dynamics, regulations, and social pressures. From the production decisions of OPEC and major producers affecting the global price of oil, to international supply routes being disrupted by geopolitical conflicts, the industry operates under constant external pressure. Yet, it has always found a way to remain resilient, adjusting its operations to match cyclical demand trends and pioneering expertise in asset management to mitigate regulatory, environmental, and production-related risks.

Sustainability and the Lifecycle of Oil & Gas Assets

Over the last three decades, sustainability-related risks have emerged as a dominant concern within and around the industry, as it faces genuine competition from lower carbon alternatives that are redefining the energy sector and its markets. Oil & Gas players have had to actively envision a strategic pivot toward more sustainable energy sources. While this new phase of pressure has presented significant challenges, it has also revealed new opportunities that continue to fuel the industry’s resilience through this transition, particularly in asset lifecycle management, as it reassesses its long-term strategic direction.

Navigating this shift in asset management involves enhancing Total Lifecycle Cost Optimization (TLCCO), a methodology that considers not only acquisition costs, but also long-term expenditures such as maintenance, downtime, emissions-related penalties, and decommissioning. Oil & Gas producers have long pioneered the application of lifecycle thinking to get ahead of hidden costs and optimize the profitability of critical assets. At its core, this methodology depends on two capabilities: the ability to identify all associated costs, and the ingenuity to reduce them.

As the world continues to pursue ambitious emissions-reduction goals such as achieving net-zero by 2050 in line with the 1.5°C global temperature cap, governments, investors, and regulatory bodies are implementing policies to make emissions visible, accountable, and costly. The EU’s Emissions Trading System caps emissions across sectors and is expanding to imported products via the Carbon Border Adjustment Mechanism (CBAM). Canada is increasing its federal carbon tax by CAD15 annually. In the U.S., states like California have implemented cap-and-trade systems, while others, for instance, Ohio, are advancing regulations related to carbon capture, utilization, and storage (CCUS).

In this piece, we explore how decarbonization efforts like carbon pricing, sustainability-linked financing, and the net zero target are reshaping cost optimization frameworks in Oil & Gas.

Carbon Pricing: Repricing the Lifecycle

Carbon pricing through taxes, trading systems, or hybrid models is rapidly expanding as a policy instrument, and its implications for asset valuation are profound. In Canada, the carbon price will reach CAD 170/tonne by 2030. In Norway, Western Europe’s largest Oil & Gas producer, the government plans to triple carbon taxes from NOK 590 to NOK 2,000 per tonne (approx. US$200), with the aim of cutting national emissions in half by 2030. The EU’s CBAM will apply a carbon cost to imported goods, impacting global supply chains. In the U.S., while there is no federal carbon tax, the Regional Greenhouse Gas Initiative (RGGI) operates a cap-and-trade system across 11 states, with penalties for exceeding emissions allowances and financial incentives for reductions.

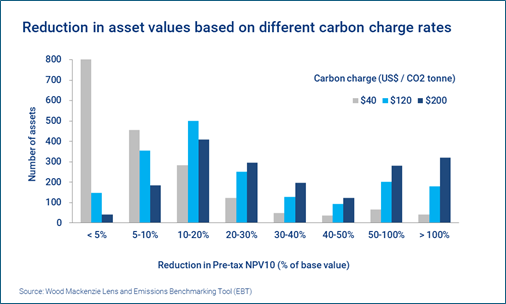

The growing adoption of carbon pricing has expanded the definition of lifecycle cost in Oil & Gas. It is no longer sufficient to model the cost of acquisition, operation, and maintenance. Now, the emissions associated with an asset across its lifecycle are being accounted for and priced in. According to modeling by Wood Mackenzie, when the carbon price reaches $200 per tonne (a scenario expected in the EU, Norway, and Canada post-2030), the value of one-third of upstream Oil & Gas assets would decline by at least 50%.

Assets once considered profitable could become stranded, not because of technical failure, but because of the rising cost of carbon. In this environment, lifecycle optimization becomes a function of carbon-adjusted economic planning - balancing operational efficiency with emissions intensity and regulatory exposure.

Sustainability-Linked Financing: Capital for Cleaner Lifecycle Performance

Another emerging lever in the evolution of asset lifecycle cost optimization is sustainability-linked financing (SLF). These are financial instruments that tie loan or bond terms to a company’s ESG performance, typically including emissions reductions, water use, or renewable energy targets.

For Oil & Gas companies, this form of financing presents an opportunity to access capital at favorable rates, reducing the long run cost of the asset. These targets often align with lifecycle goals: extending the life of an asset through retrofits or reducing emissions to avoid regulatory penalties. In other words, the better a company manages the lifecycle of its assets in sustainability terms, the cheaper its financing becomes.

Several Oil & Gas players have already leveraged SLF. In 2019, TotalEnergies secured a $3B loan tied to its sustainability performance. During the term, the company reduced Scope 1 and 2 emissions by 20%.

In 2021, Repsol issued $1.25B in sustainability-linked bonds to fund decarbonization projects. It was the first of its kind by an Oil & Gas company. The interest rate on the bonds was tied to the company meeting key emissions targets.

These examples show how SLF is becoming a tool of lifecycle influence, incentivizing retrofits, clean tech investments, and proactive emissions management. This means new opportunities to reduce lifecycle costs by hitting sustainability benchmarks that unlock better capital terms.

Strategic Scenario-Based Modeling: Asset Phasing based on Decarbonization Forecasts

The global decarbonization goal of achieving net zero by 2050 has seemed like a moving target so far. While some economies have pushed technological, regulatory, and financing bounds towards reaching this goal, others have taken a more conservative approach, intending to stay as winners should implementation fall short. Hence, Oil & Gas businesses have responded to this dynamic situation by planning the life of their assets based on multi-scenario models.

Decarbonization scenarios such as Shell’s Sky 1.5 or IEA-aligned frameworks are used to anticipate how different policy and market outcomes could affect the future cost and value of assets. These scenarios test assumptions about future carbon pricing levels, demand shifts between fossil fuels and renewables, technology penetration and electrification, stranded asset risks, and geopolitical realignments around energy policy.

Shell, for instance, uses its Sky 1.5 scenario to simulate a net-zero emissions trajectory aligned with the Paris Agreement, and actively evaluates whether projects are resilient under this model. In 2020, BP revised its long-term price assumptions, writing down billions in assets based on a less oil-intensive future outlook. But early this year, citing that the “transition has not proceeded as we would have thought”, the oil major announced an increase in its annual oil & gas investments to $10 billion and cuts to renewable energy investments by more than $5 billion. Another glaring example of asset planning based on scenario modeling.

From a TLCC perspective, this practice introduces a powerful new layer of insight. Lifecycle cost is evolving based on how climate and policy futures reshape that cost over time. As these models evolve, they are becoming standard practice for finance leaders and strategy teams managing multi-decade asset portfolios in Oil & Gas.

Dynamic TLCC Frameworks: The Path to Resilience Against Risks

Sustainability pressures, viewed as existential threats to Oil & Gas, are also catalysts for evolving asset management and financial planning. Carbon pricing, sustainability-linked financing, and scenario-based modeling are not just regulatory responses, they are strategic tools. Together, they are redefining what it means to optimize lifecycle costs in a carbon-constrained future.

In the years ahead, Oil & Gas leaders will continue to evolve their TLCC frameworks to thrive in a landscape where capital flows, asset value, and strategic alignments are increasingly shaped by sustainability performance at firm-level and systems-level.

About the Author:

Alex Hooper is an Accounting and Finance professional with expertise in risk management and leading cost efficiency programs. He manages the financial statements of multiple production facilities and sales offices within the Nord-Lock Group across the USA, Canada and Chile.