Get smart: the future of industrial automation is here

Connected machines, components, and systems are creating intelligent networks that can control each other autonomously. Industry 4.0 is happening now but how will it affect the manufacturing industry when data is the new oil?

This revolution, known as Industry 4.0, was conceived through a high-tech project launched by the German government, which promotes the computerization of manufacturing. Like all innovative concepts, Industry 4.0 is full of buzzwords such as cyber-physical systems, the Internet of things (IOT), cloud computing, and smart factories.

In a smart plant, machines can predict failures and trigger maintenance processes autonomously with self-organized logistics, which react to unexpected changes in production. Who can deny the allure of automation technology that is improved by methods of self-optimization, self-configuration, self-diagnosis, cognition and intelligent support of workers in their increasingly complex work?

Whether the manufacturing sector is prepared or not, this revolution is gathering force. Businesses will have to carefully monitor the coming changes and develop strategies to take advantage of the new opportunities, while also facing its challenges.

Linking global production

Management consulting firm McKinsey reports that it is highly likely the world of production will become increasingly networked until everything is interlinked. This is the driving force behind the Internet of Things and also means the complexity of production and supplier networks will grow enormously.

So far, networks and processes have been limited to one factory. But the new industrial step will lift the boundaries of individual factories, and even individual countries, in order to connect multiple factories all over the globe.

In addition to condition monitoring and fault diagnosis, components and systems in these factories are able to gain self-awareness and self-predictivity, which will provide management with more insight into the status of the factory.

Real-time tracking

H&D Wireless is a company that has positioned itself on the fast-growing market for industrial IoT solutions and wireless real-time tracking (RTLS). The company’s solutions support multiple wireless technologies, which are combined with security protocols, data analysis and artificial intelligence (AI).

World-renowned truck manufacturer Scania has chosen H&D Wireless as a supplier for the indoor positioning system GEPS for Industry (Griffin Enterprise Positioning Services).

According to Pär Bergsten, CEO of H&D Wireless, by using GEPS, Scania can constantly monitor and manage its fleet of robot tugs and material handling carts across their factories in real-time. Scania can use this data to optimize the utilization of expensive assets and improve efficiency while ensuring the safety and security of its employees.

“The system digitizes and visualizes physical processes and identifies — among other handling of material — production bottlenecks, uneven production flow, and unexpected machine interruptions,” says Bergsten. "Less time is wasted in the factory and throughput increases. It is easy to quickly locate the necessary tools for proper assembly using the GEPS equipment dashboard," says Bergsten.

Less time is wasted in the factory and throughput increases. It is easy to quickly locate the necessary tools for proper assembly using the GEPS equipment dashboard.

Tracked items are visualized on easy to use software on PCs, tablets and smartphones.

Besides position, Scania can monitor the condition of the tracked asset in order to know if it has been damaged or exposed to temperature extremes.

Security challenges

However, this new revolution does not only signal bright opportunities on the horizon. According to a survey by McKinsey, executives estimate that 40 to 50 percent of today’s machines will need upgrading or replacing to meet the new demands.

Security is also an issue as online integration will allow room for data leaks and security breaches. This will cost manufacturers money and might even hurt their reputation. Consequently, research into the security is crucial.

Establishing who owns the data accumulated from networks of connected machines and components may also prove difficult — especially with the value of data constantly increasing.

Data is the new oil

The Internet of Things is viewed as a major component in this transition, and for good reason. It involves the use of big data, connected sensors, autonomous machines, and artificial intelligence. By fitting sensors onto industrial components, launching connectivity to systems, collecting data and using advanced computer processing, companies hope to boost productivity and efficiency.

Pierre Kellner, Business Developer, Smart Products & Services at Nord-Lock Group, says that in the past, data was gathered from surveys, research, and other external sources. Now, sources of data are being supplemented by the product itself, and its value increases exponentially when it is integrated with other data.

“It is crucial to start collecting and owning big data, although we do not know the value of the data today. Data is the new oil,” says Kellner.

It is crucial to start collecting and owning big data, although we do not know the value of the data today. Data is the new oil.

Monitoring bolts

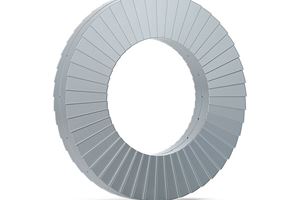

When it comes to bolted joints, there are several fields that will benefit from connected sensors and AI, such as aircrafts and airports, trains and railways, mining equipment, bridges, oil platforms, nuclear power plants, and wind parks.

In the case of wind parks, the offshore variety are preferred since they can be built on a large scale, enjoy better efficiency due to higher wind speeds and have less noise considerations than their onshore counterparts.

However, these turbines have hundreds of bolts each — a number that will likely increase into the thousands as they get bigger and which could cause many problems. "Since access is hard and in some cases dangerous this makes services difficult and thereby expensive," says Kellner.

Several sources estimate that the operation and maintenance cost will contribute to between 20 and 25 percent of the cost of offshore energy, compared to 10 to 15 percent onshore.

The remote analysis, monitoring and reporting capabilities offered by Industry 4.0 would make this more efficient and affordable — advantages that are set to revolutionize not only the bolting sector but the manufacturing industry as a whole.