Offshore floating wind energy starts moving into high gear

Imagine producing 11 times more electricity than the entire world needs, using only offshore wind turbines. This may well be possible, reports the respected International Energy Agency, IEA.

The enormous potential that offshore wind energy may be able to offer has been making headlines around the world. In late 2019 the Norwegian energy giant Equinor confirmed that its massive investment in the 88 MW Hywind Tampen Offshore Floating Wind (OFW) farm was going ahead. A few days later the International Energy Agency, IEA, released a major report with astonishing news. It concluded that offshore wind, not just floating but also including fixed-bottom structures, could generate 11 times more electricity than the world needs and attract $1 trillion in capital investments by 2040. Clearly, things are happening in wind power.

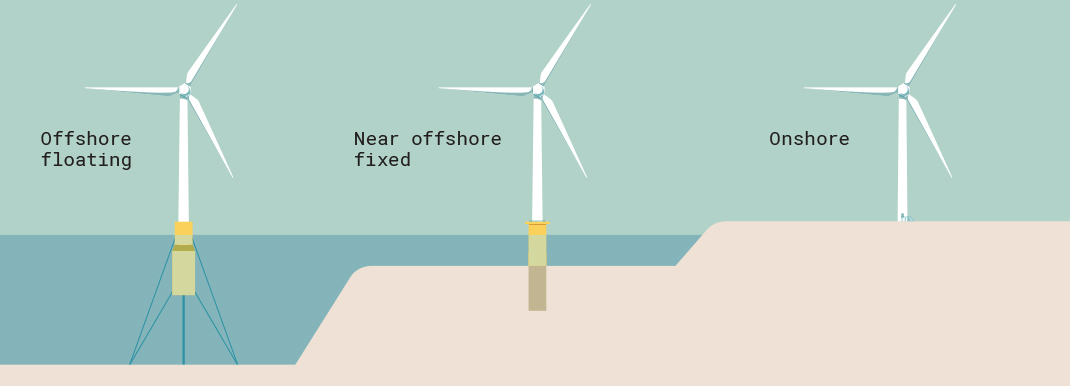

Three wind subsectors, based on location

As a background, today’s modern wind power sector can be roughly divided into three categories, depending on where the turbines are located, and the design used to hold them up. These are: Onshore (with land-based support fixture), Near offshore fixed (with support fixed in the seabed), and Offshore floating (mounted on a platform floating above the seabed) — See Figure 1 on next page. Offshore Floating Wind (OFW) technology involves a turbine mounted on a buoyant structure, giving it the very important advantage of allowing it to generate electricity in water depths greater than 60 meters — where bottom-mounted structures fixed to the seabed are no longer feasible. While both onshore and offshore fixed wind power generation capacity has grown enormously over the past decades, many industry experts believe that OFW may hold the greatest potential for future growth. This is due to its ability to be located in deeper water farther from shore where more consistent high wind speeds reduce fluctuations in electricity generation. A secondary driver that may help accelerate OFW is the growing public resistance to wind turbines being placed where they can be seen or heard.

Low-hanging fruit has been harvested

OFW is also getting more attention due to the simple fact that the “low-hanging fruit” that many onshore and near offshore wind sites offer has already been harvested. Of course, there are potentially thousands of other onshore and near offshore wind locations that still can be developed, but the growing resistance to seeing and hearing the turbines is also having an impact. It’s the “NIMBY” syndrome, meaning Not In My Back Yard, which refers to infrastructure installations that society generally needs, such as power plants or garbage dumps, but that nobody wants to have located near to where they live.

Equinor CEO: 80% is in deep waters

This combination of drivers has turned greater attention to OFW, which can be used in deeper waters. When announcing Equinor’s final decision to go ahead with the 88-MW Hywind Tampen project, involving an investment of around USD 550 million, company CEO Mr. Eldar Sætre was very clear about the company’s decision:

About 80 percent of the global resource potential for offshore wind is in deep waters” says Equinor CEO Eldar Sætre.

“And floating offshore wind may play an important part in the energy transition toward more sustainable global energy supply,” he continues.

A key motivator for Equinor to undertake this project is that the electricity generated will be used on the nearby Gullfaks and Snorre oil platforms, directly reducing the use of gas and thereby CO2 emissions by 200,000 tons per year.

Steppingstone to 1,000 MW

Arne Eik, Equinor’s Lead Business Developer for Offshore Wind, explains that Tampen is just one step on the company’s path to utility-scale projects with high cost effectiveness. “The existing 30 MW Hywind Scotland proved that floating offshore wind works, and the 88 MW Hywind Tampen will be almost three times as big,” says Eik. “Within a few years, we hope to realize a 200-400 MW project, and then be on our way to utility-scale projects of more than 1,000 MW. “I should add that we are achieving cost reductions of around 40% from Hywind Scotland to Hywind Tampen. Looking further out, we are very confident we’ll continue to get significant cost reductions as we scale up on the next project after Hywind Tampen. So Hywind Tampen is clearly a technological and industrial development project, a steppingstone to building an industry of great importance which creates value by producing clean energy and at the same time reducing CO2 emissions.”

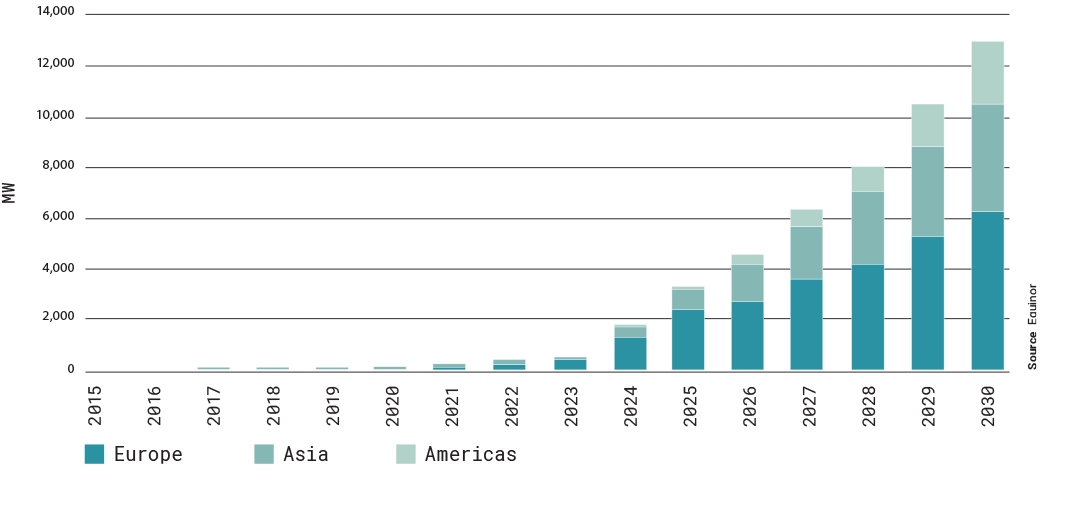

Rapid pace from infancy to massive investments

Erik Rijkers, Director of Market Development & Strategy at the market intelligence group Quest Floating Wind Energy, says that although only five years ago floating wind energy was in its infancy, and meeting more naysayers than believers, it has now come a very long way in terms of delivering new floater designs, scaled demonstrators, pre-commercial projects and new players. “The entry of companies such as Equinor, Repsol, SBM, Aker Solutions and, most recently, Shell has led to a step-change for this young industry’s viability and ultimate capability to produce 50 or 100 Floating Turbine Units (FTU) on a serial manufacturing basis,” Rijkers explains. “Floating wind energy is a fast-moving market,” he continues, “and Europe has been the global ‘test bed’. The success of recent projects like Hywind Scotland and Windfloat Atlantic will drive export of this technology to the USA and Asia well before 2025. This move to large-scale projects, aided with ample financial backing, will help to improve efficiencies and lead to significantly reduced costs. We see this trend, in turn, making further European projects more feasible, buoyed by additional government support of long-term Floating Wind Energy developments.”

Many countries only have deep sites available

Charlotte Obhrai, an Associate Professor in offshore wind research at the University of Stavanger in Norway, is confident that floating wind energy has a bright future.

To meet future energy targets, wind is essential” says Charlotte Obhrai.

“And in many countries the easier-to-reach near-offshore sites are already taken. Some countries such as Japan simply have no or very few shallow sites. Thus, deeper sites are the future and that means floating.” Also, she says, wind speeds are generally higher further out and the amount of power you can produce goes up to a power of three with increasing wind speed.

So even a small rise in average wind speed makes a big difference in power output and technology is clearly developing to tap that potential. Of course, there are challenges to be met, especially regarding construction and installation costs, for the floating substructure. “There are numerous concepts being used and tested,” continues Obhrai. “There will likely continue to be numerous designs, since the right one for a particular location is based on several factors such as depth of the nearest harbor, local manufacturing skills and capabilities, etc.”

Outlook positive, but trends difficult to extrapolate at this point

Matthew Hannon, a Senior Lecturer at the University of Strathclyde in Glasgow Scotland, states that while it is probably prudent to be somewhat cautious about how fast OFW will develop, the trend is clear and positive. “Although the long-term outlook is optimistic, at this time OFW has a very small installed base so it’s difficult to extrapolate with confidence. And any failure of a project to materialize can have negative effects on confidence,” he concedes. “Nonetheless, taking all factors into account, we are projecting very steady growth in the global capacity of floating wind power by 2030. The important point is that this growth is closely mirroring the growth rates that the near-offshore-fixed wind industry experienced. So we think that during the 2030s, barring unforeseen issues, OFW will really kick into high gear from a solid base. Floating wind will be viewed, like near-offshore wind today, as a legitimate low-risk energy investment with similar dynamic growth rates.”

Exciting times ahead

Exactly how fast offshore wind will grow is clearly open to numerous interpretations. But the trend is unmistakable, and it will obviously be interesting to see how both the market and the technology will develop in the coming years.

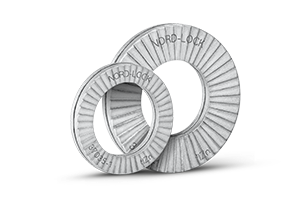

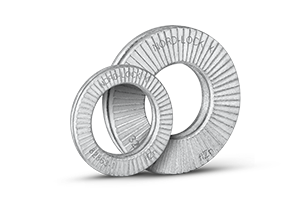

Are bolted joints the weak link?

“Life assessment of bolts is something the wind industry struggles with, as it is the weakest point on the tower life calculation. There seems to be a blind spot in that area as the bolts aren’t considered as part of standard life calculations, which are all based on aero elastic codes.”

David McMillan at the University of Strathclyde in Glasgow

“Predicting the performance and reliability of bolted connections throughout the lifetime of a floating asset is a challenge, both because of their physical size and the harsh environments where they are being deployed.”

Tomas Svendsen – Nord-Lock Group Norway